They say absence makes the heart grow fonder. That certainly seems to be the situation with the Ford Bronco. Prices of vintage Broncos have soared in anticipation of Ford’s announcement that, at 8 p.m. Eastern time Monday, July 13, it finally will unveil not only the new Bronco, but the first 4-door Bronco and a new, smaller version called the Bronco Sport.

The vehicles aren’t the only part of the Bronco rebirth. Ford ended production of its 4×4 sport utility vehicle in 1996 but says the Bronco will return not only in three versions but as a new “outdoor brand” encompassing an online Bronco Nation community, off-road driving schools, off-pavement driving adventures, and more.

The pent-up demand for the new Bronco goes well beyond vehicle buyers. The companies that produce automotive aftermarket parts eagerly await the Bronco’s return, or should we say Broncos’ return.

According to the annual SEMA Market Report: Tracking the Automotive Specialty Equipment Industry, a COVID-19 constricted 2020 will reduce aftermarket sales of parts and pieces by around 20 percent, to a projected $40.7 billion for the year. That figure follows a 3.6 percent gain in sales in 2019, when sales reached a record $46.2 billion.

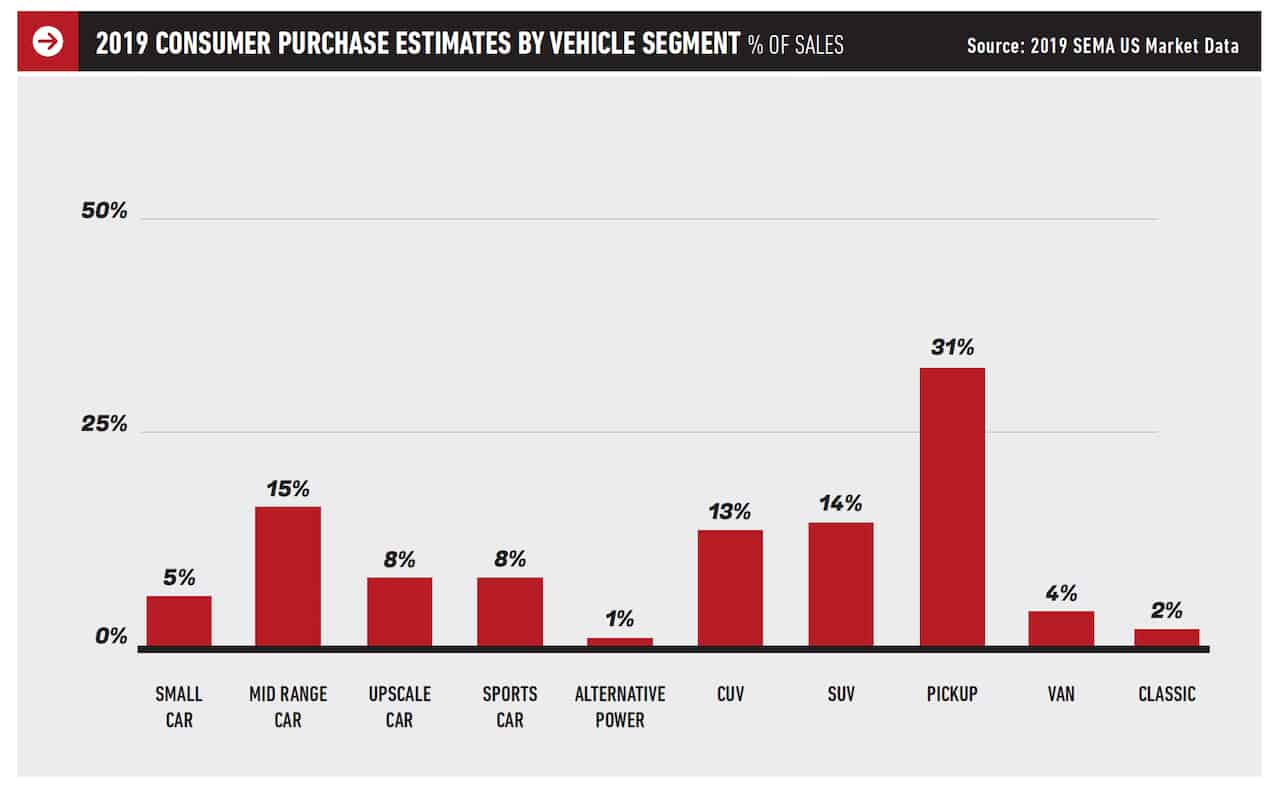

Pickup trucks account for 31 percent of those sales, with midsize cars, sport utility vehicles and crossover utility vehicles at 15, 14 and 13 percent, respectively.

(Since this site focuses on classic cars,we note that such vehicles — SEMA says they include the 1964 Pontiac GTO, 1968 Porsche 911, 1939 Studebaker Champion — account for only 2 percent of aftermarket retail sales. Still, that represents $800 million spent annually. By the way, SEMA reports that of 4 million classic vehicles, 21 percent are reported in non-operational condition.)

While CUVs are the fastest growing category in new-vehicle sales, Gavin Knapp, SEMA director of market research, notes that although CUVs account for many sales, there are dozens and dozens of different models, each with relatively small sales, and that makes it difficult for aftermarket companies to know which models might become popular for modification.

However, he adds, if you look at full-size pickups, at SUVs such as the Jeep Wrangler, and at muscle/performance cars, not only are there fewer models, but those vehicles often are owned by people eager to do personalization and customization.

Ford and its dealers are among those ready for such aftermarket sales, already launching an Amazon store even before unveiling the vehicles themselves. Also already in operation is the Bronco Nation website, which plans to offer what it calls Off-Rodeo events in four “epic” locations.

It is easy to anticipate that the new Bronco will spark a surge in aftermarket sales as new owners seek to outdo their Jeep-owning neighbors.

“We’ve seen a huge amount of interest in the new Bronco,” Knapp said. “There’s been a lot of talk about what it can be, and Ford has done a good job in promoting it that way, that it can be anything you want it to be.”

But it’s not only vehicles such as the Jeep and new Bronco that can drive aftermarket equipment sales. When it comes to customization and personalization, nearly 40 percent of those aged 16-29 are buying and installing and of those 30-39, 34 percent are aftermarket customers, according to the annual SEMA report.

Further, those involved in off-roading, or own recreation vehicles, ATVs, boats or motorcycles are twice as likely to be aftermarket consumers.

Knapp also noted that with many people homebound by the pandemic, they have time to work on their vehicles.

“There’s a lot of stuff in the media that young people don’t like cars,” he said. “I have research that shows the opposite.” While younger enthusiasts may not have as much income as older enthusiasts, they may not have the responsibilities of families, careers, mortgages and such.

“There is a large number who like cars and are going to spend money on their cars,” Knapp said, adding, for example, that those aged 16-24 spend around $8 billion a year on their vehicles.