What’s the state of the current collector car marketplace?

“Crazy. Bonkers. Bananas,” said David Kinney, long-time vehicle appraiser and founder of the Hagerty Price Guide.

“It’s powered by nitrous,” added Wayne Carini, long-time vehicle restorer and collector car television-show host.

Kinney and Carini joined yet another restorer and collector, Colin Comer, and moderator Larry Webster for Hagerty’s annual Scottsdale seminar, albeit held this year as a livestreamed internet event rather than on-site in Arizona. The seminar’s theme: “How to navigate a heated seller’s market.”

“We find informed buyers and sellers are happy buyers and sellers,” McKeel Hagerty said in introducing the event. He noted that only 10 percent of all collector car transactions take place at auctions, meaning that the vast majority of sales are private transactions.

Tracking its customers’ purchases and sales, Hagerty noted that in the past year, 71 percent of all vehicles sold for more money than their purchase prices, typically for 13 percent more money.

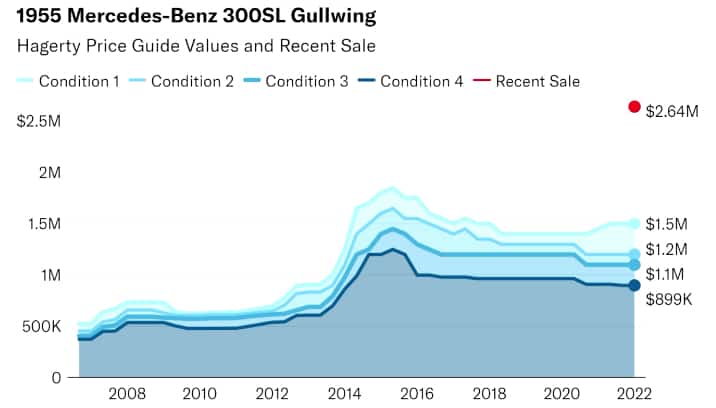

But the reality of those statistics is overshadowed by the seemingly crazy prices being produced in the nitrous-injected atmosphere of both live and online auctions where, for example, a Gullwing Mercedes 300SL sells for a million dollars more than expected or where a vintage national park tour bus that sold at auction in the fall of 2020 for $450,500 rolls off the auction block earlier this month for $1.43 million.

“Scottsdale looks like a continuation of what happened in Florida (at the recent and record-setting Mecum Kissimmee sale),” Kinney said. “It’s a very, very, very vibrant market and there aren’t a lot of signs of that slowing down.”

“There are times the market has climbed and then it calms down,” Carini added. “But this just keeping ramping up. Just as we think it’s hitting its peak, it goes up some more. We haven’t seen it like this.

“Covid let people use their cars and enjoy them, and they see friends dying and want to enjoy their own lives, and people are flush with cash. People are indulging in their passions.”

And, Kinney pointed out, it’s not just the expensive vehicles that are selling for strong numbers. “Everything is selling,” he said. “It’s a good time to be rejiggering your collection.”

Speaking of rejiggering, Comer said he’s seeing clients trading rather than selling, even if it means taking several vehicles in exchange for, say, a car worth $2.5 million. One reason is taxes; keeping a car for a year and a day before selling at a profit qualifies for the advantage of long-term capital gains rather than windfall profit taxation, he added.

Carini noted that during earlier marketplace surges, it often was speculators inflating the bubble.

“This is different,” he suggested. “Past markets like this it was speculators, buying and flipping, taking third mortgages on their homes. Now people have the money. They aren’t financing. they’re writing checks or making wire transfers. Now we’re seeing end users who buy these cars and take them home to enjoy.

“What (collectors) cars meant during covid was using them, to be able to get out and go for a ride.”

The panel also noted that there are new and younger people joining in the fun. Carini said Mecum reported 30 percent first-time bidders at its recent Kissimmee, Florida, auction. Comer said Barrett-Jackson has 2,500 first-time bidders this week in Scottsdale.

“New people (likely) have some modern collector cars,” Comer added, “but (now) they want to do vintage tours and rallies.”

Kinney said he’s seeing a lot of 20- and 30-year-olds who already have an older BMW or Volkswagen or Ford or pickup truck that they enjoy driving.

“That speaks volumes about where this market is going to be in 10 or 15 years,” he said, adding that this new generation of enthusiasts appears to be committed to the hobby long term.

But are there still bargains to be had? The panelists said there are, but suggested being flexible when going to an auction.

“Go to an auction with an open mind,” Kinney said, “not just looking for that one great car.”

And buy what you love, the panelists agreed, and if you have cars in your garage you don’t love, now in this nitrous-charged marketplace is the time to sell them.

Is there a way to see the prices that each car sold for??

If you go to the various auction company websites, you should be able to find those details.

Yes. Take a look at each auction’s website, which should have the results. Some of them, such as Barrett-Jackson’s, require you to register to see the results, but that’s not a problem.